n The period a mortgage can stay delinquent varies by lender and kind of mortgage. Generally, if payments aren't made for ninety days, the lender might provoke collection actions.

n The period a mortgage can stay delinquent varies by lender and kind of mortgage. Generally, if payments aren't made for ninety days, the lender might provoke collection actions. After a number of months of delinquency,

이지론 if no remedy is reached, the account might go to collections or threat foreclosu

Eligibility for women’s loans can range significantly relying on the lender, however usually, several common criteria apply. Most lenders search for a steady supply of revenue, whether from employment, self-employment, or different means. Credit history also plays an important role; having a great credit score score will increase the probabilities of

Daily Loan approval at favorable phrases. Additionally, some lenders could require collateral for secured loans, whereas unsecured loans could demand a higher credit score rat

n A month-to-month loan is a sort of financing the place the borrower repays the borrowed amount in mounted monthly installments over a set interval. These loans could be secured in opposition to property or unsecured, depending on the lender's phrases. They provide debtors with a predictable repayment schedule and entry to essential funds without requiring upfront savi

Business loans, on the opposite hand, are designed to help feminine entrepreneurs in starting or expanding their ventures. These loans typically come with specialized recommendation and mentoring opportunities, which may be invaluable for girls entering the business wo

Popular Monthly Loan Options

There are numerous types of monthly loans tailored to meet particular wants. Personal loans are versatile and can be used for a spread of purposes, from home improvements to medical bills. These loans often include mounted compensation schedules, making budgeting managea

BePick is a useful online platform dedicated to offering comprehensive data and reviews about women's loans. It serves as a one-stop resource for girls looking for readability on their financial choices. Through detailed articles, skilled critiques, and consumer experiences, BePick delivers insights that can empower women to make informed selections about loans and financial merchandise obtainable to them. Furthermore, BePick collaborates with monetary establishments to guarantee that the information is correct and present, thus building trust amongst its custom

Women looking for loans ought to put together a transparent proposal outlining how they intend to utilize the funds, as this transparency can enhance their possibilities of approval. Furthermore, being conscious of the lender’s social initiatives can assist girls in finding supportive monetary institutions that prioritize gender equ

Despite the constructive developments within the lending panorama for women, a quantity of misconceptions persist. One frequent fable is that women are much less creditworthy than their male counterparts. In actuality, many studies present that ladies are sometimes extra accountable borrowers, making timely repayments and managing money owed effectiv

Importantly, some financial establishments have developed specific criteria recognizing the potential earning capability of ladies, especially in sectors like entrepreneurship and training. This strategy encourages lenders to assist girls who could in any other case face challenges in conventional lending practi

There are varied kinds of loans tailored specifically for girls. Some of the most common include private loans, enterprise loans, and academic loans. Personal loans can cover a spread of bills, corresponding to medical payments, home renovation, or journey, providing flexibility for women to handle unexpected pri

Interest charges for ladies's loans can differ widely relying on the lender and the type of mortgage. However, many financial institutions offer competitive charges to encourage girls to borrow. Factors influencing the interest rate embody the borrower’s credit rating, reimbursement history, and economic circumstances. It's advisable to compare rates from completely different lenders to secure one of the best d

Eligibility Criteria for No-document Loans Eligibility for a *no-document loan* usually revolves round several key elements. Primarily, **creditworthiness performs a crucial role**; lenders usually have a look at credit score scores as a big indicator of threat. Additionally, lenders might contemplate the worth of assets or collateral to safe the mortgage. **This means that people with an excellent credit historical past or substantial assets could find it easier to qualify for these kind of loans**. However, potential borrowers ought to always strategy lenders to grasp their specific eligibility tips, as they can differ widely between financial establishme

BePick: Your No-document Loan Resource

For individuals seeking comprehensive details about *no-document loans*, the BePick web site stands out as a useful resource. **BePick offers in-depth reviews, analyses, and comparisons of assorted mortgage options**, offering clarity to potential debtors. The web site ensures that customers can explore varied lenders’ choices, phrases, and interest rates, enabling informed selections that align with their monetary conditions. Beyond mere listings, BePick also educates guests on finest practices for navigating the borrowing landscape, helping them to avoid pitfalls and make sound decisi

Beneficios de la vitamina C para las manchas en la cara

Beneficios de la vitamina C para las manchas en la cara

See What Toto Online Terbaik Tricks The Celebs Are Making Use Of

By Floy Barney

See What Toto Online Terbaik Tricks The Celebs Are Making Use Of

By Floy Barney A importância do equilíbrio: como lidar com traços rígidos de personalidade

A importância do equilíbrio: como lidar com traços rígidos de personalidade

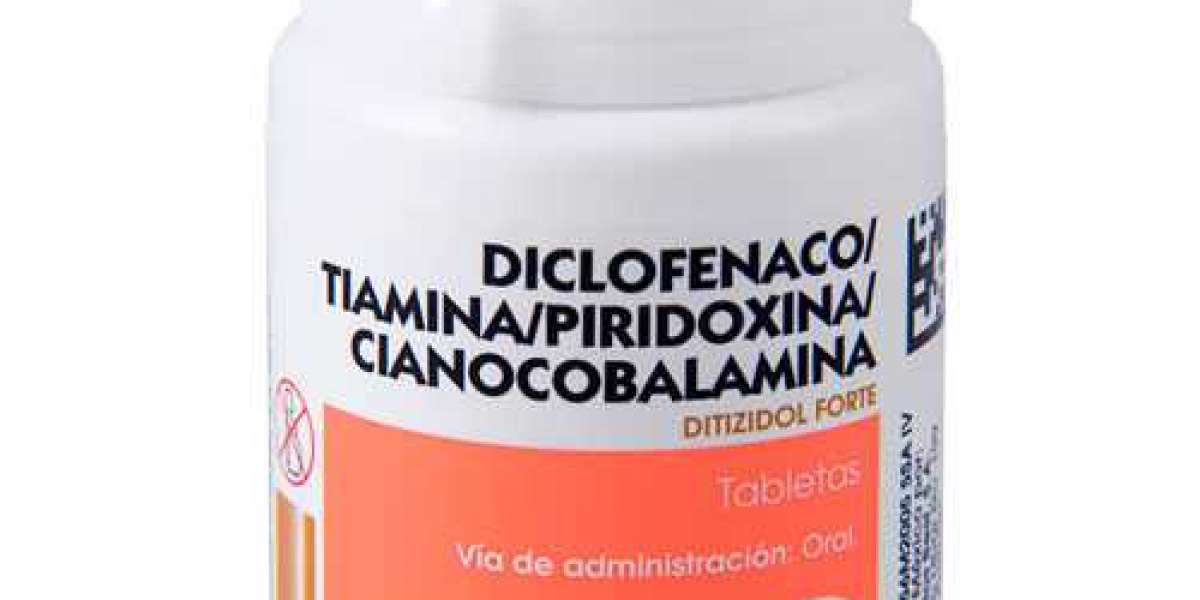

Qué hace la vitamina B12 en tu cerebro, cuerpo, ADN y glóbulos rojos

By Mei Graziani

Qué hace la vitamina B12 en tu cerebro, cuerpo, ADN y glóbulos rojos

By Mei Graziani 20 Receitas de Brigadeiro de Copinho & Combinações Para Conquistar Quem As Prova

20 Receitas de Brigadeiro de Copinho & Combinações Para Conquistar Quem As Prova