Global Last Mile Delivery Market Projected to Reach USD 106.42 Billion by 2030, Driven by E-commerce Boom and Technological Advancements

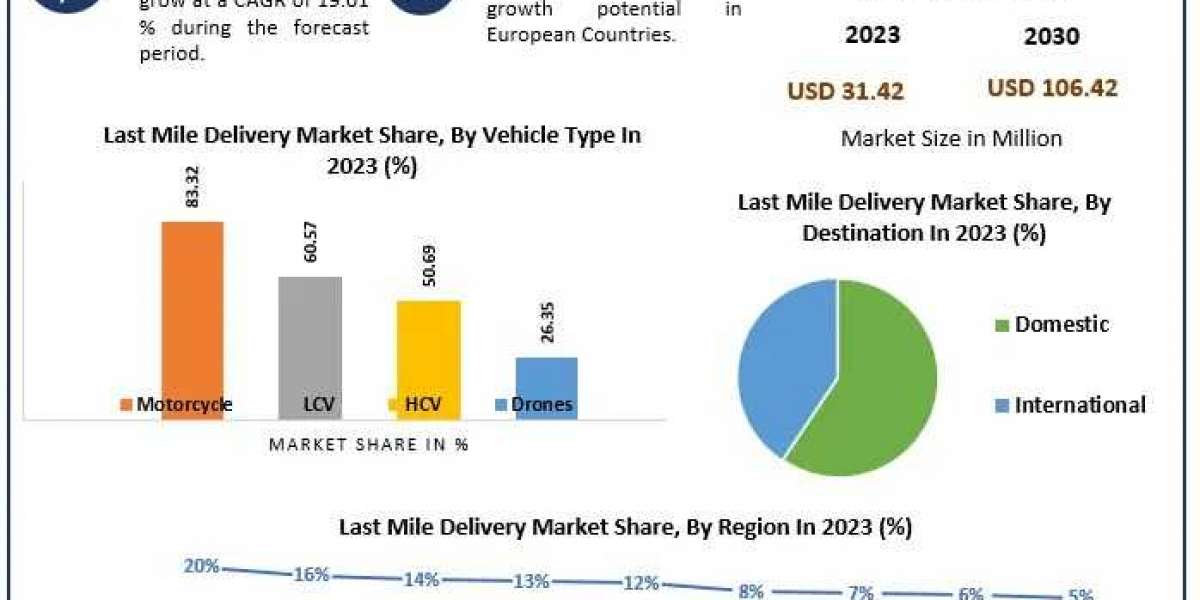

The global Last Mile Delivery Market Share is on a trajectory of significant growth, with projections indicating it will reach approximately USD 106.42 billion by 2030, up from USD 31.42 billion in 2023. This expansion represents a compound annual growth rate (CAGR) of 19.01% from 2024 to 2030.

Market Definition and Scope

Last mile delivery refers to the final phase of the supply chain, where goods are transported from a distribution hub to the end customer's location. This stage is crucial as it directly impacts customer satisfaction, emphasizing prompt and efficient delivery to the doorstep.

To access more comprehensive information, click here:https://www.maximizemarketresearch.com/request-sample/31481/

Market Growth Drivers and Opportunities

Several key factors are propelling the growth of the last mile delivery market:

E-commerce Expansion: The exponential rise in online retail has heightened the demand for swift and efficient delivery services, making last mile delivery a focal point for retailers aiming to meet customer expectations.

Technological Advancements: The integration of automation, artificial intelligence (AI), and autonomous vehicles is revolutionizing delivery processes. Innovations such as electric delivery vans, robotic delivery units, and drone networks are enhancing efficiency and speed in the last mile delivery sector.

Sustainable Practices: There is a growing emphasis on eco-friendly delivery options, including the adoption of electric vehicles and optimized delivery routes, aimed at reducing carbon footprints.

Segmentation Analysis

The last mile delivery market is segmented based on service type, vehicle type, and end-user:

By Service Type:

- Business-to-Business (B2B): Involves deliveries between businesses, such as bulk shipments to retailers.

- Business-to-Consumer (B2C): Encompasses direct deliveries to consumers, a segment experiencing significant growth due to e-commerce.

By Vehicle Type:

- Light Commercial Vehicles (LCVs): Commonly used for urban deliveries due to their maneuverability and cost-effectiveness.

- Heavy Commercial Vehicles (HCVs): Utilized for larger shipments and bulk deliveries.

- Drones and Autonomous Vehicles: Emerging technologies aimed at enhancing delivery speed and efficiency, particularly in congested urban areas.

By End-User:

- E-commerce Retailers: Major users of last mile delivery services to fulfill online orders.

- Food and Beverage: Relies on timely deliveries to maintain product freshness.

- Healthcare: Requires precise and timely deliveries for medical supplies and pharmaceuticals.

Click here for a more detailed explanation:https://www.maximizemarketresearch.com/request-sample/31481/

Country-Level Analysis

United States: The U.S. market is experiencing rapid growth in last mile delivery services, driven by a robust e-commerce sector and consumer demand for faster deliveries. Companies are investing in technologies like autonomous delivery vehicles to enhance efficiency.

Germany: Germany's strong logistics infrastructure supports the growth of last mile delivery services. The country's emphasis on sustainability is leading to the adoption of eco-friendly delivery options, including electric vehicles and bicycle couriers.

Competitive Landscape

The last mile delivery market is characterized by intense competition, with key players focusing on technological innovation and strategic partnerships to enhance their market position. Notable companies include:

Amazon: Investing heavily in autonomous delivery technologies and expanding its logistics network to ensure faster deliveries.

UPS: Implementing AI and data analytics to optimize delivery routes and improve efficiency.

FedEx: Exploring the use of autonomous vehicles and robotics to streamline last mile delivery operations.

DHL: Focusing on sustainable delivery solutions, including the deployment of electric vehicles and bicycle couriers.